Have you ever paused to consider what would happen to your family's financial well-being if you were no longer around? It's time to recognize that securing a life insurance policy isn't merely a prudent act; it's a fundamental pillar of comprehensive financial planning, delivering invaluable peace of mind and establishing a lasting legacy of protection for those you cherish most.

The realm of life insurance is diverse, offering a range of policies, each distinguished by unique features and advantages. Understanding these differences is paramount when making well-informed decisions. Term life insurance, whole life insurance, and universal life insurance stand out as the most prevalent options. Term life insurance provides coverage for a defined period, whereas whole life insurance offers lifelong protection and includes a cash value component. Universal life insurance blends death benefit protection with a cash value component that can be adjusted as your needs evolve. AAA Life Insurance Company is a provider that offers a spectrum of life insurance solutions, including term, whole life, and universal life policies.

| Category | Details |

|---|---|

| Company Name | AAA Life Insurance Company |

| Headquarters | Livonia, Michigan |

| Contact | 844.759.9758 |

| Website | AAA Life Insurance |

| Types of Insurance Offered | Term Life, Whole Life, Universal Life, Express Term Life |

| Coverage Area | Licensed in all states |

To gain a comprehensive understanding, let's delve into the intricacies of the life insurance policies available through AAA Life Insurance Company. We will explore the various policy types, their respective benefits, and how they can be tailored to meet your specific requirements.

- Movierulz 2025 Your Guide To South Indian Cinema More

- Hdhub4ukiwi Is This Free Movie Streaming Site Safe Find Out

To obtain a quote from AAA Life Insurance, you can either call them directly at 844.759.9758 or visit their website for a free online quote.

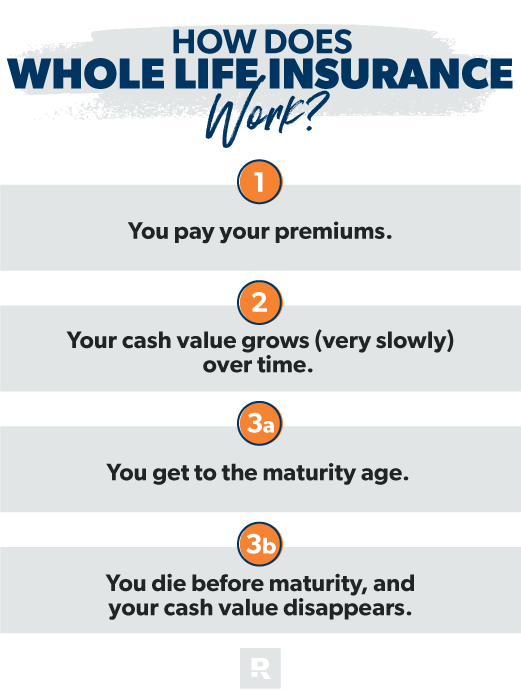

Whole life insurance stands as a form of permanent life insurance, furnishing coverage for your entire lifetime, contingent upon the consistent payment of premiums. A significant advantage of whole life insurance lies in its level premiums, guaranteeing that the cost of your policy remains constant throughout its duration. Moreover, whole life policies accumulate a cash value, which grows over time on a tax-deferred basis, offering a financial safety net alongside the death benefit.

Before committing to any life insurance policy, it is crucial to thoroughly understand its terms and conditions. This entails scrutinizing the specifics of the benefits, any exclusions, and other key policy provisions. For a complete understanding of the terms and conditions of insurance coverage, it is advisable to consult your insurance professional or refer directly to the policy document. Life insurance policies are underwritten by AAA Life Insurance Company, located in Livonia, Michigan, and the company holds licenses in all states.

- Ullu Review 2024 Is This Ott Platform Worth Watching Now

- Decoding Wasmo Somali Culture Sex Amp The Digital Mirror

The principal features of a whole life insurance policy are outlined below.

| Feature | Description |

|---|---|

| Permanent Coverage | Provides lifelong protection, as long as premiums are paid. |

| Level Premiums | Premiums remain the same throughout the life of the policy. |

| Cash Value Growth | Accumulates cash value over time, tax-deferred. |

| Loans and Withdrawals | Allows policyholders to borrow against the cash value. |

| Death Benefit | Pays a death benefit to beneficiaries upon the insured's death. |

AAA Life Insurance

In contrast to whole life insurance, term life insurance delivers coverage for a defined term, typically spanning from 10 to 30 years. Should the insured pass away during this term, the death benefit is paid to the designated beneficiary. Notably, term life policies do not accrue any cash value. AAA offers a diverse selection of policies, including Term, Express Term, Whole Life, and Universal Life insurance.

Universal life insurance presents a hybrid approach, integrating death benefit protection with a cash value component. Unlike whole life insurance, universal life policies offer enhanced flexibility, enabling policyholders to adjust their premiums and death benefit within specific parameters. The cash value within a universal life policy grows in accordance with the performance of the policy's underlying investments, providing the potential for increased financial growth.

For individuals prioritizing simplicity and affordability, AAA Life offers a streamlined whole life insurance policy that eliminates the requirement for a medical examination. To secure approval, applicants need only answer a limited set of questions, select coverage ranging from $5,000 to $25,000, and entrust AAA Life to manage the rest. This simplified approach caters to those seeking immediate and straightforward coverage.

AAA Life Insurance Company is committed to providing a wide array of life insurance products and services designed to accommodate the diverse needs of families at every stage of life. Whether you have already chosen a policy or are still evaluating your options, AAA streamlines the process of obtaining a quote or seeking assistance with any questions you may have. You can easily obtain an insurance quote online or by phone, allowing for convenient access to information.

AAA Life insurance for seniors provides financial security designed to meet the unique needs of your family, acknowledging the evolving priorities associated with later stages of life. These policies offer valuable peace of mind for both seniors and their loved ones.

For applicants dealing with pre-existing health conditions, a guaranteed issue whole life insurance policy can represent a viable option. This type of policy typically forgoes the requirement of a medical examination, thereby increasing accessibility for individuals who may encounter difficulties in qualifying for more traditional coverage. This guaranteed issue whole life policy is often referred to as graded benefit whole life insurance, and it is subject to specific age requirements and policy limit restrictions.

For those primarily focused on maximizing cash value growth, whole life insurance stands as an excellent choice. The cash value component of a whole life policy accumulates over time, evolving into a valuable asset that can be utilized for various future needs, from funding retirement to covering unexpected expenses. This cash value component is a distinctive feature of permanent life insurance policies.

Whole life insurance can also be a compelling choice for foreign nationals seeking to safeguard their wealth and create a lasting legacy. With coverage options spanning from $30,000 to $75,000, these policies can provide assistance with final expenses and outstanding debts, serve as a supplement to existing term life insurance policies, and furnish an additional source of income for beneficiaries, contributing to long-term financial stability.

When embarking on the process of selecting a life insurance policy, it is imperative to carefully consider the features and benefits that align most closely with your individual needs and priorities. What matters most to you and your family? The key lies in identifying a policy that not only fits your budget and meets your coverage requirements but also provides the peace of mind that you rightfully deserve. AAA Life is committed to offering valuable educational resources that shed light on traditional term life insurance policies, as well as the comprehensive range of insurance packages that they offer. Their dedication to providing informative articles and educational tools empowers you to gain a deeper understanding of life insurance and how it can serve as a vital tool in protecting those who matter most, even after you are gone.

In addition to their core life insurance offerings, AAA Life extends a variety of supplementary services aimed at assisting customers with their diverse insurance needs. These services encompass online quote tools, direct access to licensed insurance professionals who can provide personalized guidance, and a wealth of educational resources designed to empower informed decision-making. To initiate the process of securing your financial future, contact AAA Life today for a complimentary quote.

While exploring your life insurance options, it is prudent to consider that switching to AAA car insurance could potentially yield substantial savings on your premiums, allowing you to allocate those funds toward bolstering your life insurance coverage or addressing other financial priorities. To assess the potential savings, visit AAA to receive a free quote and discover how much you could save on your car insurance premiums. Embark on the journey to finding the ideal policy tailored to your unique needs, whether it be Term, Express Term, Whole Life, or Universal Life insurance. Take advantage of the opportunity to obtain a free quote online.

Selecting the appropriate life insurance policy is a pivotal decision that necessitates careful consideration of your unique circumstances and long-term financial objectives. By acquiring a thorough understanding of the various policy types available and the distinct features they offer, you can make an informed choice that provides enduring protection and financial security for your loved ones. It is important to note that the premiums associated with permanent policies will remain consistent throughout the life of the policy. AAA offers a wide range of insurance options to meet your specific requirements.

Protect your loved ones with the dependable support of AAA Life Insurance. With coverage options ranging from $5,000 to $75,000, you can tailor your policy to meet your family's specific needs. If approved, you can secure lifelong coverage. AAA Life's whole life insurance policy is an excellent choice for individuals seeking a reliable and affordable option that eliminates the need for a medical examination, simplifying the application process.

By submitting a request for information, you acknowledge and agree to receive calls, text messages, or prerecorded messages pertaining to products and services offered by AAA Life Insurance Company or its affiliated entities, including partner companies, clubs, agencies, subsidiaries, and authorized representatives (a comprehensive list of these entities is available). These communications may be delivered to the phone number provided, including your wireless number if applicable. This consent enables AAA Life Insurance Company to furnish you with pertinent information and updates regarding their insurance offerings.

Preparing for my family's future.

Whether you have already selected a policy or are still exploring your options, AAA streamlines the process of obtaining a quote or seeking answers to any questions you may have. Their commitment to customer service ensures a seamless and informed experience.

- Joe Scarboroughs Health Whats Really Going On The Truth

- Guide Where To Download Bollywood Movies In Hd Legally Safely